Mastering Year-End: Your Comprehensive Tax Preparation Guide from Acumen MB LLC

Hello valued clients and fellow financial enthusiasts,

As the year draws to a close, it’s time to gear up for one of the most important financial tasks – tax preparation. At Acumen MB LLC, we understand that the year-end hustle can be overwhelming, so we’ve crafted this comprehensive guide to help both individuals and businesses navigate the intricacies of tax preparation.

Individual Tax Preparation:

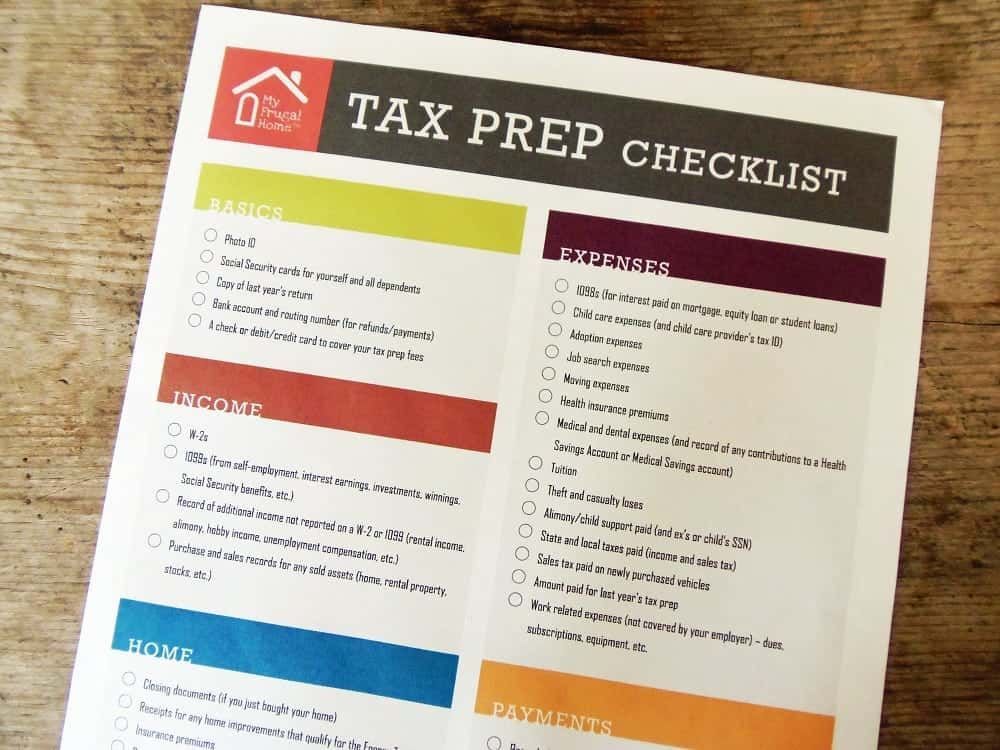

1. Gather Personal Information:

a. Social Security Numbers for yourself and dependents

b. Employment and income information (W-2’s, 1099s)

c. Any additional income sources (rental, investments, etc.)

2. Review Deductions and Credits:

a. Charitable contributions

b. Education expenses

c. Medical expenses

d. Homeownership-related deductions

3. Organize Receipts and Records

a. Keep track of any business expenses if you’re self-employed

i. If you use your vehicle for business, charitable, or medical purposes, it’s essential to update your mileage logs. Keep track of the miles driven, purpose of the trip, and related expenses.

ii. If you work from home, you may be eligible for the home office deduction. Keep records of your home-related expenses, such as mortgage interest, property taxes, utilities, and maintenance/repair costs. Additionally, maintain a clear record of the square footage of your dedicated home office space relative to the total living space.

b. Document medical expenses, job-related expenses, and education expenses

4. Consider Retirement Contributions

a. Maximize contributions to your IRA or 401(k) for potential tax savings

5. Plan for Health Coverage:

a. Ensure compliance with health insurance requirements

6. Review Changes in Personal Circumstances:

a. Marriage, divorce, new dependents – these can impact your tax situation

Business/Corporate/Partnership/LLC Tax Preparation:

1. Collect Financial Statements:

a. Balance sheets, income statements, and cash flow statements

2. Review Business Expenses:

a. Gather receipts for all deductible expenses

b. Mileage and home office deduction, if applicable

c. Ensure proper categorization for tax purposes

3. Evaluate Depreciation:

a. Assess the depreciation of assets for potential deductions

4. Employee Information:

a. W-2s for employees

b. 1099s for contractors

5. Consider Tax Credits:

a. Research and leverage available tax credits for your business type

6. Review Changes in Business Structure:

a. Any changes in structure may impact tax obligations

Checklist of Documents for Individuals:

- Social Security Numbers for taxpayer, spouse, and dependents

- W-2s and 1099s

- Charitable contribution receipts

- Education expense documents

- Medical expense records

- Homeownership-related documents

- Retirement contribution statements

- Health coverage documentation

Checklist of Documents for Businesses:

- Financial statements (balance sheets, income statements, cash flow statements)

- Receipts for all deductible expenses

- Asset depreciation records

- Employee W-2’s and contractor 1099’s

- Documentation for tax credits

- Records of any changes in business structure

At Acumen MB LLC, we’re committed to making your year-end tax preparation as smooth as possible. If you have any questions or need personalize assistance, don’t hesitate to reach out to our dedicated team at 216-859-7001.

Wishing you a stress-free and financially successful year-end!