Student Loan Repayment Programs: A Win-Win for Employers and Employees

In today’s competitive job market, employers are constantly seeking new ways to attract and retain top talent. With voluntary turnover rates reaching record highs, companies are looking for any edge they can get. One increasingly popular benefit that has been gaining traction is student loan repayment programs. These programs offer a win-win solution for both employers and employees, and recent changes in tax laws have made them even more affordable.

Thanks to the Consolidated Appropriations Act, signed into law in 2020, employers can now offer up to $5,250 in student loan repayment benefits without paying any tax. This change has made student loan repayment programs more accessible to a wider range of employers, and as a result, more and more companies are offering some form of loan repayment support. In fact, by October 2023, 34% of employers were offering student loan benefits, up from just 17% in 2021.

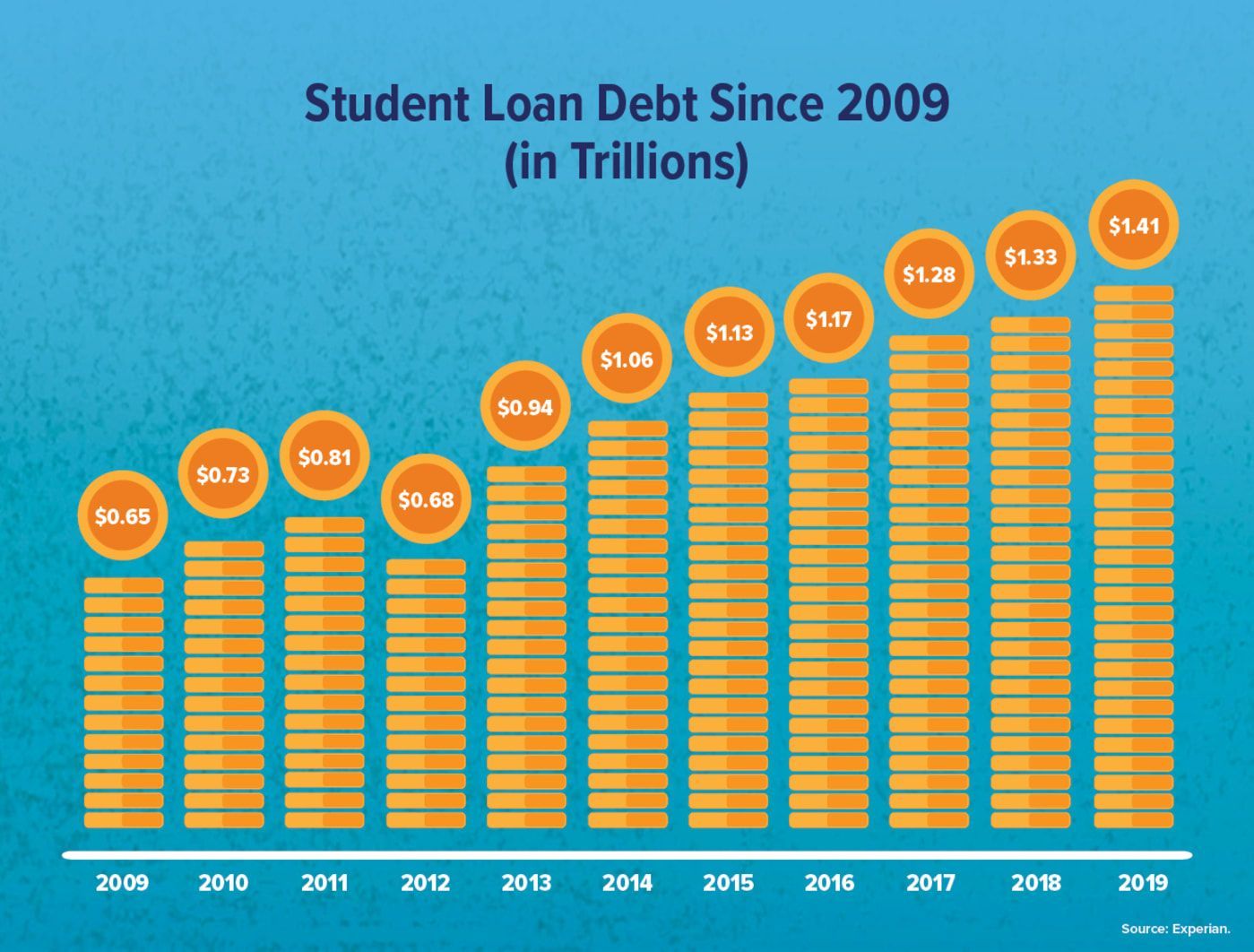

The need for student loan repayment programs is clear when you consider the scale of the student loan epidemic in the United States. Nearly 44 million Americans owe more than $1.6 trillion in student loans, making it the fourth highest U.S. debt category. The average federal student loan debt balance is nearly $38,000, and when you factor in private loan debt, the total average balance may be more than $54,000. Given these staggering numbers, it’s no wonder that student loan repayment benefits could be a major draw for job candidates.

For employers, offering student loan debt relief can help attract and retain talent more easily. Studies have shown that 86% of workers would commit to an employer for five years if the employer offered student loan support. This can lead to increased employee loyalty and engagement, as well as improved productivity and job satisfaction.

Setting up a student loan repayment program is relatively straightforward, especially with the help of a financial organization that offers program management. However, if you prefer to handle it yourself, here are a few tips to keep in mind:

1. Determine the monthly payments you want to contribute, keeping in mind that even small amounts can save employees thousands of dollars in interest.

2. Set a cap on the maximum amount you’ll contribute.

3. Decide who will be eligible to receive the benefit, keeping in mind that nondiscrimination rules do not apply to student loan repayment programs.

4. Consider requiring a specific work commitment from the employee in exchange for loan repayment assistance.

It’s also worth noting that there have been recent updates to 401(k) plans that allow employers to help employees pay off their student loan debt without sacrificing an employer retirement match. This can be a particularly attractive benefit for employees who are struggling to save for retirement while also paying off their student loans.

In conclusion, student loan repayment programs can be a valuable tool for employers looking to attract and retain top talent. By offering this benefit, employers can help their employees pay off their student loans faster, improve their financial health, and increase their loyalty and engagement. And with recent changes in tax laws, these programs are more affordable than ever.

Want more information?