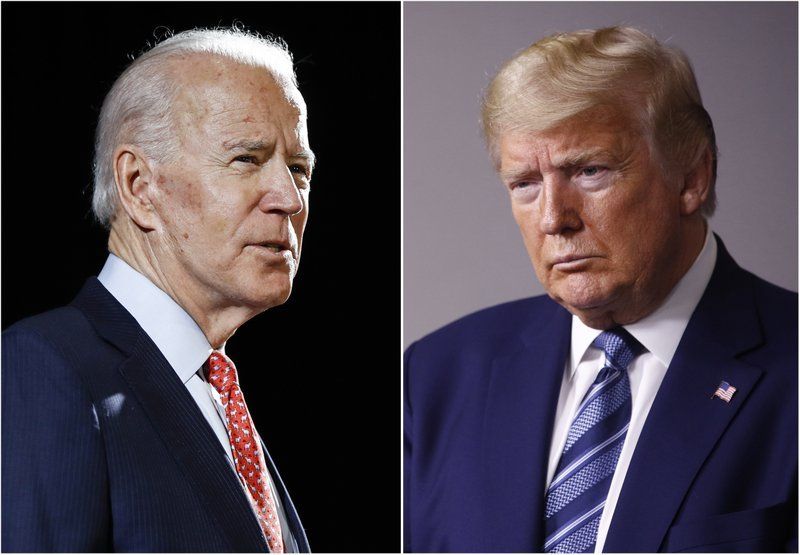

Where Do the Presidential Candidates Stand on Tax Issues?

A lot has happened to all of us over this past year. For myself, this has been a period of positive change professionally. I have reconstituted my CPA practice with the help and support of my family and those individuals who have joined me in my practice and I could not be more enthusiastic of the people who have joined me on this journey. My staff has been entrusted with providing client support, handling the administrative functions, and tasked with social media outreach, allowing me to spend most of my time on issues that affect my clients. I appreciate the comments many of you have given to me and will continue to listen and implement changes based on your feedback.

It comes as no surprise that we have an election on November 3rd. As with any election, one of the major talking points is the area of taxation and the positions of the presidential candidates regarding current and proposed legislation. Both sides have made their positions known to the public on these topics. This article is intended to explain each candidate’s position and in no way reflects the opinion of Acumen MB LLC and its employees.

INDIVIDUAL TAXATION

Income Tax Rates

Under current law, there are seven tax brackets: 10,12, 22, 24,32, 35, and 37 percent. These are in effect through 2025.

TRUMP: He has floated the idea of a new 10 percent middle income tax cut but for the most part wants to extend these rates beyond 2025.

BIDEN: He has proposed increasing the top rate back to 39.6 percent which was in effect prior to 2018.

Capital Gains/Dividends

Under current law, a capital gains rate of 0 percent, 15 percent, or 20 percent applies to capital gains and qualified dividends received by individuals, depending upon the amount of the individual’s taxable income. For 2020, the 20 percent rate applies to joint filers with taxable incomes over $496,600 ($469,050 for heads of households, 441, 450 for single filers, and $248,300 for married taxpayers filing separately).

TRUMP: He has stated that he would propose cutting the maximum capital gains rate to 15 percent if reelected. His 2021 fiscal year budget proposal would extend the applicable tax provisions as currently on the books beyond 2025. In addition, Trump has indicated he would be open to indexing capital gains to inflation.

BIDEN: His proposal would increase the top marginal income tax rate on long-term capital gains to 39.6 percent for taxpayers earning more than $1 million annually and eliminate the step-up basis tax expenditure that allows decedents to pass capital gains to heirs without tax.

Child Tax Incentives

Under current law, the maximum Child Tax Credit is $2,000 through 2025. Additionally, an earned income tax credit (EITC) up to $6,557 may be available in 2020, depending on income and family size, as well as a dependent care credit up to $2,100.

TRUMP: Trump has no currently proposed expansions to child tax incentives. His 2021 fiscal year budget proposal would extend current provisions beyond 2025.

BIDEN: Biden has proposed expanding the EITC and dependent care credit. Further, Biden has proposed a refundable $8,000 child care tax credit for a qualifying child or up to $16,000 for two or more children. Additionally, Biden proposes a new $5,000 tax credit for caregivers of individuals with certain physical and cognitive needs.

BUSINESS TAXATION

Corporate Tax Rates

Under current law, the corporate tax rate for C corporations is 21 percent.

TRUMP: Trump has no currently proposed changes.

BIDEN: Biden proposes increasing the corporate tax rate to 28 percent. Additionally, Biden proposes a minimum tax on corporations with book profits of $100 million or more.

Qualified Business Income Deduction

Under current law, the Section 199A deduction allows eligible taxpayers such as partnerships/LLC’s and S corporations to deduct up to 20 percent of their qualified business income (QBI), plus 20 percent of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. The deduction is scheduled to expire after 2025.

TRUMP: Trump supports extending the applicable tax law provision beyond 2025.

BIDEN: Biden has proposed phasing out the qualified business income deduction for incomes above $400,000.

Energy Tax Incentives

Various credits are available under current law for oil production, electric vehicles, as well as for the production of solar, wind, and other “green” energy.

TRUMP: Trump has no currently proposed energy tax incentives.

BIDEN: Biden proposes ending subsidies for fossil fuels, restoring the full electric vehicle tax credit and various credits and deductions to incentivize both residential and commercial energy efficiency.

Please take every opportunity to learn more about each candidate’s positions to make an informed decision.

** With acknowledgement to CCH Incorporated